After almost two weeks of hovering just above the $50K mark, the price of Bitcoin has just resumed its ascent to the top with a spectacular price rise on February 26, 2024. This rise allowed the price of Bitcoin to touch $57K, a price level not reached since the end of November 2021:

As you can quickly see on this weekly chart, the momentum was different back then, as the Bitcoin price had just beaten its ATH at $69K.

Right now, we're in an ultra-positive momentum that could take the price of Bitcoin towards $150K by the end of 2024. I recently gave you 4 factors to justify this thesis:

The 4 Factors That Will Push Bitcoin’s Price Towards $150K by the End of 2024.

3 factors put forward by a famous investment strategist, plus a fourth as a bonus.

In the wake of Bitcoin's price rise, you might be wondering what tipped the scales in the Bulls' favor when some of the Bears were hoping to push the price of Bitcoin back under $50K.

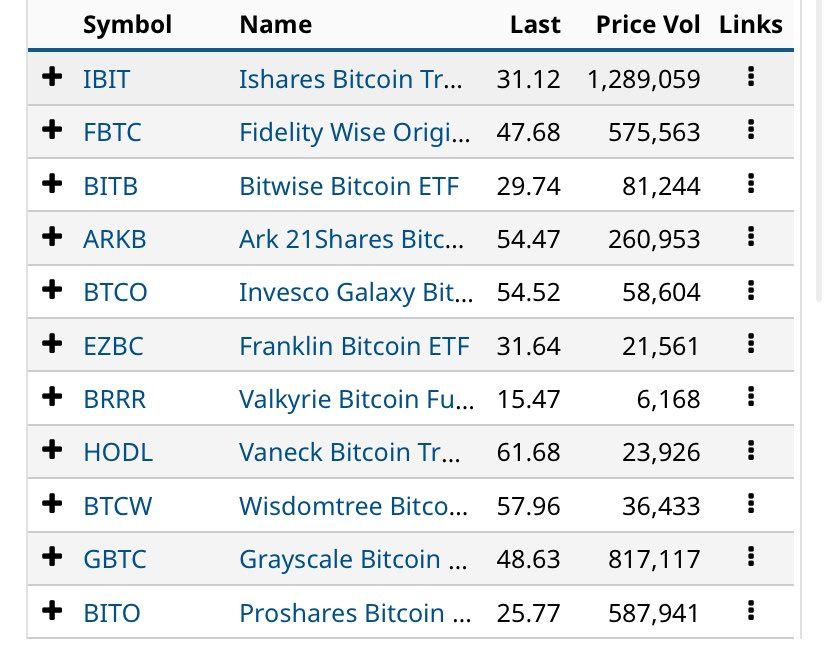

As always since the start of 2024, it was the financial giants who made the difference. Volume for the 9 Bitcoin Spot ETFs exceeded $2 billion on February 26, 2024, reaching $2.35B.

On the podium was BlackRock with $1.289B, Grayscale with $817M, and Fidelity with $576M:

As long as the demand for Bitcoin is so strong from these giants of global finance, you can be sure that the Bears won't be able to push the price of Bitcoin below $50K.

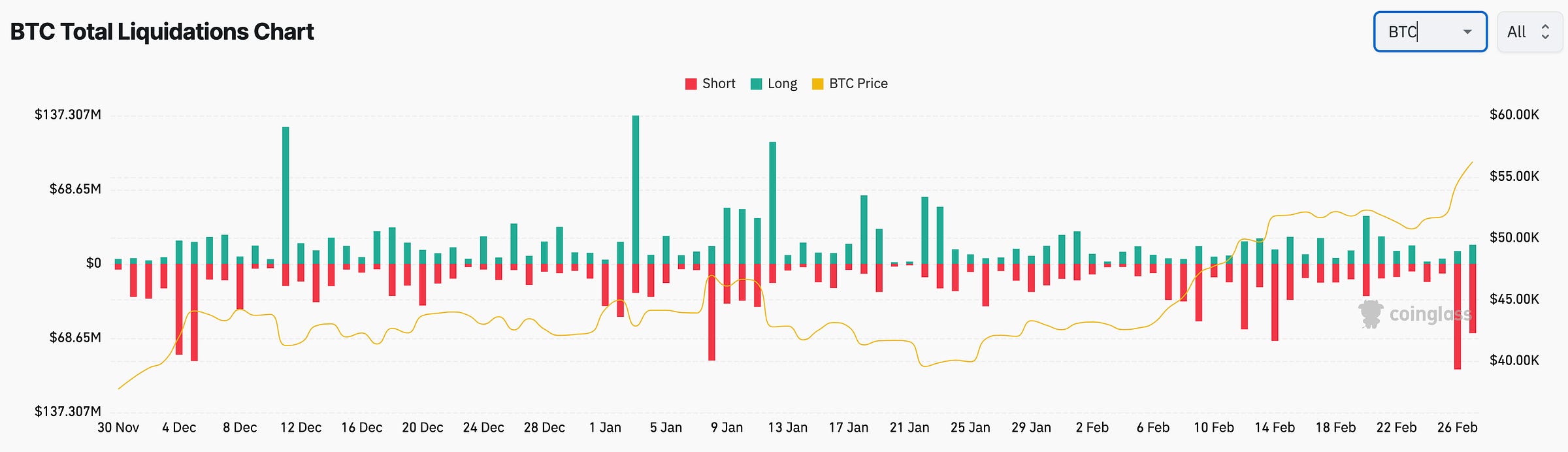

The opposite is true. Those who short Bitcoin are paying a high price. More than $189M of short Bitcoin positions have been liquidated in the last 24 hours:

A real purge that will perhaps teach these shorts that there's no point in fighting these financial giants when they have an objective in mind.

And their objective is clear: to absorb ever more BTC!

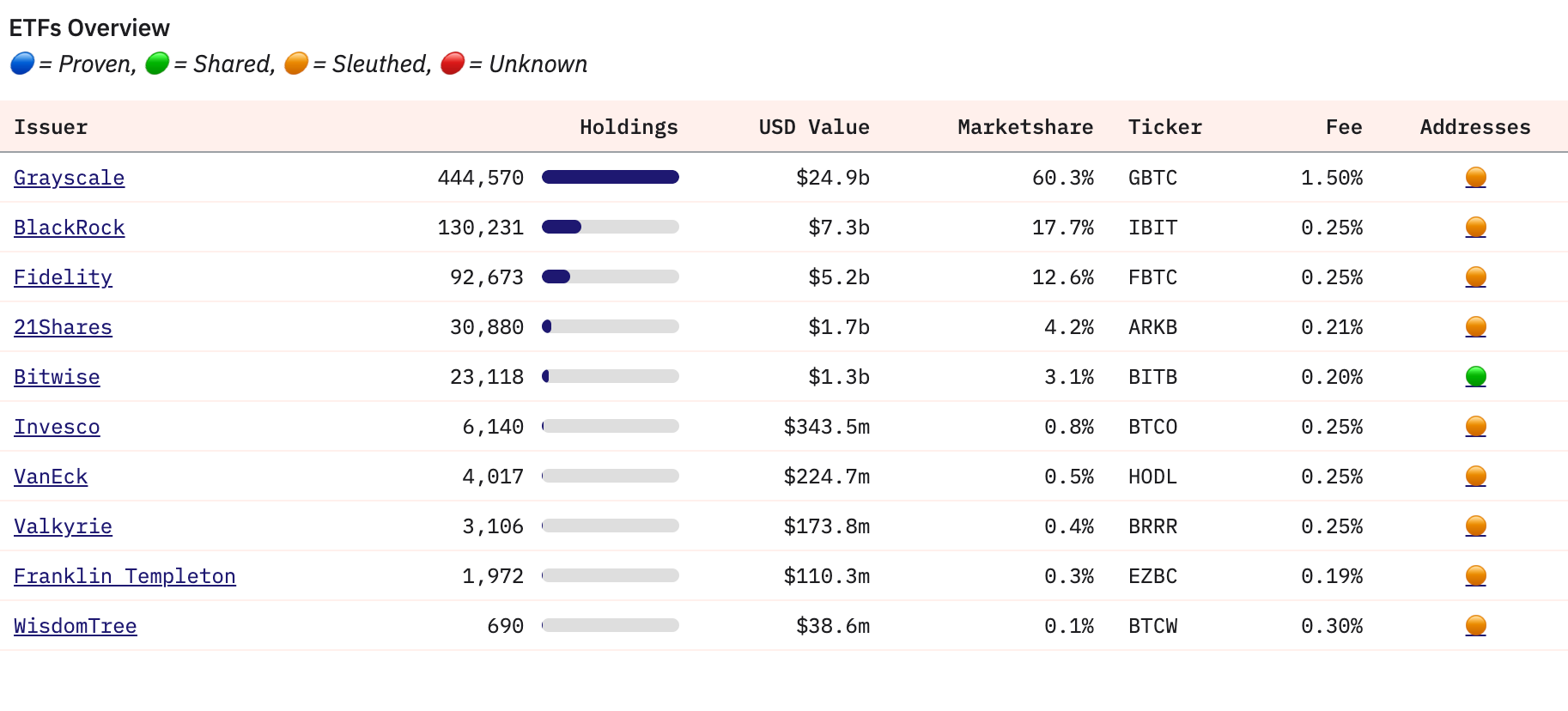

These financial giants now own a combined 3.75% of Bitcoin's circulating supply:

Grayscale, BlackRock, and Fidelity occupy the top three places here.

Continuing to accumulate BTC in this context of scarcity of supply available for purchase can only be a good decision in my eyes. But as always, it's up to you to decide.

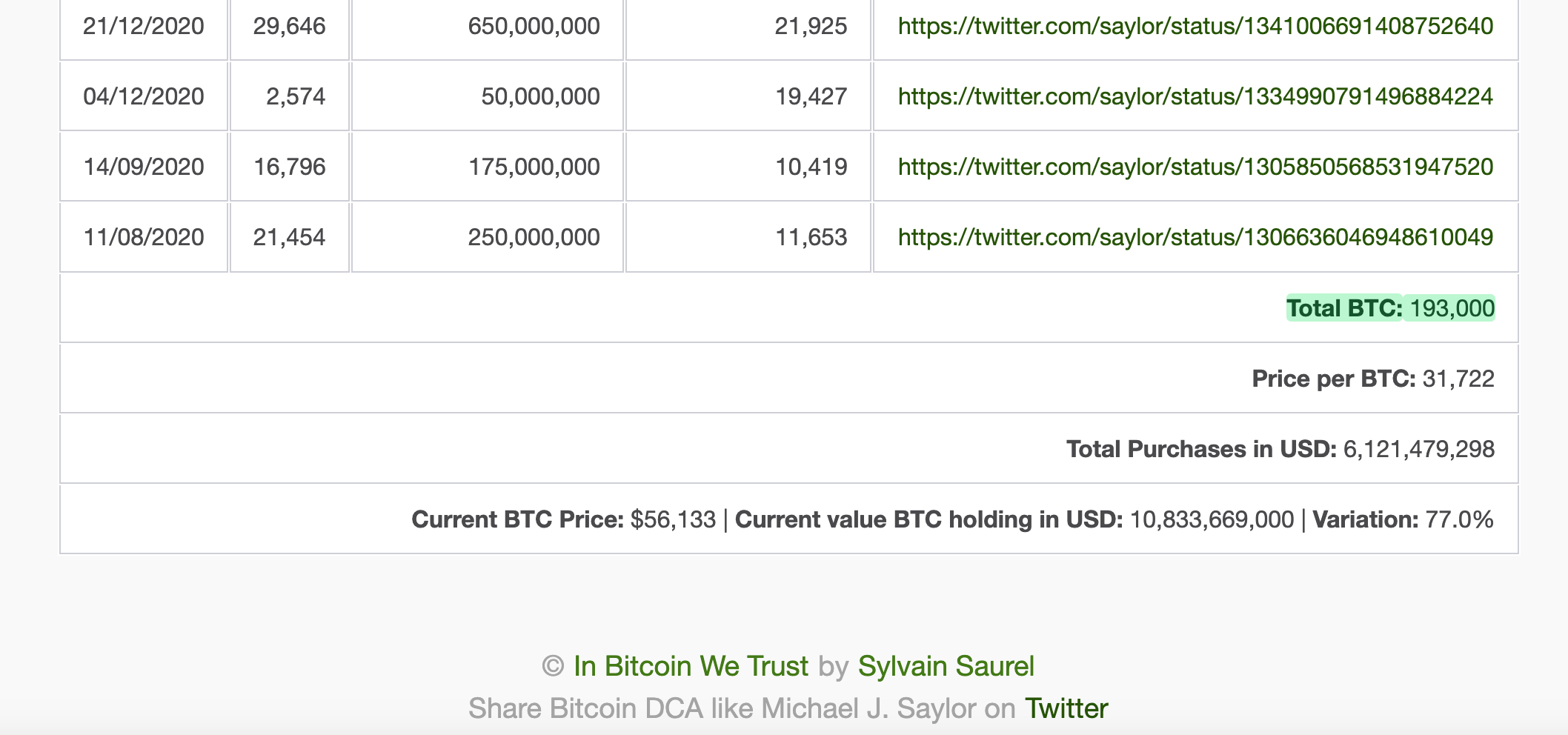

Michael J. Saylor understood the urgency of the situation, even though MicroStrategy already held 190K BTC. Yesterday, he announced a new purchase of 3,000 BTC by MicroStrategy. MicroStrategy now holds 193K BTC and is closing in on its target of owning 1% of the BTC supply.

Mass Media sees $10B in BTC for MicroStrategy, Michael J. Saylor sees 0.904% of Bitcoin's total supply.

Michael J. Saylor reminds us of the difference in perception between the general public and those who have understood the why of Bitcoin.

MicroStrategy's position in Bitcoin represents more than $10.8B at the current price:

However, you don't need to ask yourself what would happen if Michael J. Saylor were to sell Bitcoin. Why would he do that? Because Michael J. Saylor has already said that he would never sell Bitcoin. On the other hand, MicroStrategy will continue to buy Bitcoin at any price.

This strategy is only possible once you've understood why Bitcoin exists. It has a name: it's a DCA strategy. The beauty of this strategy is that it's not only the simplest, but it's also the most effective. Best of all, it's accessible to everyone.

For those of you new to the world of Bitcoin today, I have even better news: don't worry, you can never be late with a revolution like Bitcoin. I'll explain why here:

Don’t Worry, You Can Never Be Too Late With Bitcoin.

The reason lies in the profound meaning of the Bitcoin revolution.

Of course, if you open your eyes to Bitcoin today, you may have some regrets.

This is particularly true of South African comedian Trevor Noah, who was speaking yesterday at the Web Summit Qatar 2024 in Doha. He was asked a simple question: what's the biggest mistake you've made in your life?

His answer should be of interest to those who still refuse to open their eyes to the Bitcoin revolution:

“The biggest mistake I've ever made was not buying Bitcoin when it was nothing, that's the biggest mistake I've made. Bitcoin cost nothing at some point.”

After that answer, I'd have been tempted to point out that his biggest initial mistake was something else entirely, and that not buying Bitcoin was just a consequence of that initial mistake.

But Trevor Noah himself made this clarification by stating that another mistake he had made was “not taking the time to understand Bitcoin”.

To me, this is the initial mistake that far too many people make. They see Bitcoin as just another financial investment. When they see its price above $50K, they might think it's too late. This is where you need to study the why of Bitcoin to understand that it's never too late to secure the fruits of your labor within the Bitcoin network.

So, whatever the price of Bitcoin in weak money as the USD, placing the fruit of your labor outside the debt-based system, which is flawed and not fixable, is tantamount to protecting it and securing your future.

When this debt-based system collapses, your wealth in Bitcoin cannot be unloaded. If you own 1 BTC, you'll always have 1 BTC in 21 million units. That's essential. Better still, no one will be able to censor you in the use of your Bitcoin.

That's where Bitcoin's value proposition lies. Once you understand this, you'll no doubt be applying the same strategy as Michael J. Saylor with MicroStrategy.

What can you expect next for the price of Bitcoin?

It's hard to say. I'd be inclined to tell you that a major correction will take place in the short term before Bitcoin's fourth Halving. My experience in the Bitcoin world leads me to believe this.

However, with these global financial giants ready to absorb all the BTC that comes up for sale, it might not happen as usual, and we might why not reach a new ATH even before Bitcoin's fourth Halving.

In any case, my advice will be the same as I've been giving since late 2016 in the articles I write about Bitcoin. With the price of Bitcoin, don't expect anything in particular, but be prepared for anything. This will help you to be patient in any situation.

You must be logged in to post a comment.